Video game industry employment trends reveal how cyclical hiring and layoffs shape not just individual studios but the broader competitive landscape across platforms and regions, where product cycles, financing conditions, and consumer appetite converge to determine workforce needs. Viewed through video game industry hiring trends, the cycle moves from downturns to renewed expansions, with studios recalibrating project pipelines, reassigning talent, and seeking new roles in live service development, porting, and cross-platform publishing. In recent years, gaming industry layoffs shaved thousands of positions from studios across the sector, even as some teams pressed ahead with ambitious new IP, greater use of AI-assisted workflows, and modular, scalable production models. Some companies expanded, but not enough to absorb all the staff displaced, leaving a net headcount decline that pushed many professionals toward freelance work, contract roles, or opportunities in adjacent tech, education, or digital media. The latest data, while imperfect, suggests the pace of recovery remains uneven, offering cautious guidance for hiring plans and underscoring the value of flexible staffing strategies, talent pipelines, and ongoing reskilling in a fluctuating market.

In terms of related terminology, the conversation around the game development jobs market often refers to talent acquisition in video game studios, as studios pivot toward longer-term staffing plans and flexible contractor pipelines. Other phrases you may see include video game studio staffing, live operations talent, and the broader interactive entertainment workforce, all pointing to similar dynamics of project-based hires, cross-functional teams, and skill diversification. LSI-driven analysis would connect these ideas with shifts in recruitment channels, compensation models, and upskilling initiatives, emphasizing that surface terms hide a common set of needs for adaptable engineers, artists, designers, and producers. Taken together with the first paragraph, this framing helps readers anticipate where opportunities may appear as the cycle turns, and why employers value flexible staffing and multi-role capability.

Video game industry employment trends: Reading the Cycle of Growth and Contraction

The videogames industry moves in cycles, and the pattern of booms followed by consolidations is a familiar story to workers and studios alike. In times of growth, hiring accelerates as development teams expand and new projects ramp up; during downturns, layoffs and restructuring become common as companies tighten budgets and reassess priorities. This ebb and flow shapes the broader narrative of video game industry employment trends, echoing across studios of all sizes.

From a workforce perspective, those cycles translate into periods of optimism followed by hiring slowdowns, with many thousands of jobs potentially affected during lean years. The job market tightens as studios shrink headcount, only to re-open as growth returns. Observers should watch for early signals in the gaming industry layoffs data and in early recruitment activity to gauge when the green shoots of new growth begin to appear.

Mapping the Cycle: How the Game Development Jobs Market Responds to Boom and Bust

When growth resumes, the game development jobs market tends to rebalance quickly, as studios rebuild core teams, hire for key capabilities, and invest in new IPs. The speed and composition of this rebound depend on project pipelines, funding cycles, and the competitive environment for talent in areas like design, programming, art, and QA. This dynamic is central to understanding how employment prospects shift across the industry.

LSI-focused indicators, such as hiring-rate changes, project announcements, and studio expansions, provide a proxy for the pace of recovery. Analysts also monitor reported shifts in the number of open roles and the geographic spread of opportunities. While these signals are useful, they must be interpreted alongside broader industry signals to avoid overreacting to temporary volatility in the market for video game studio staffing.

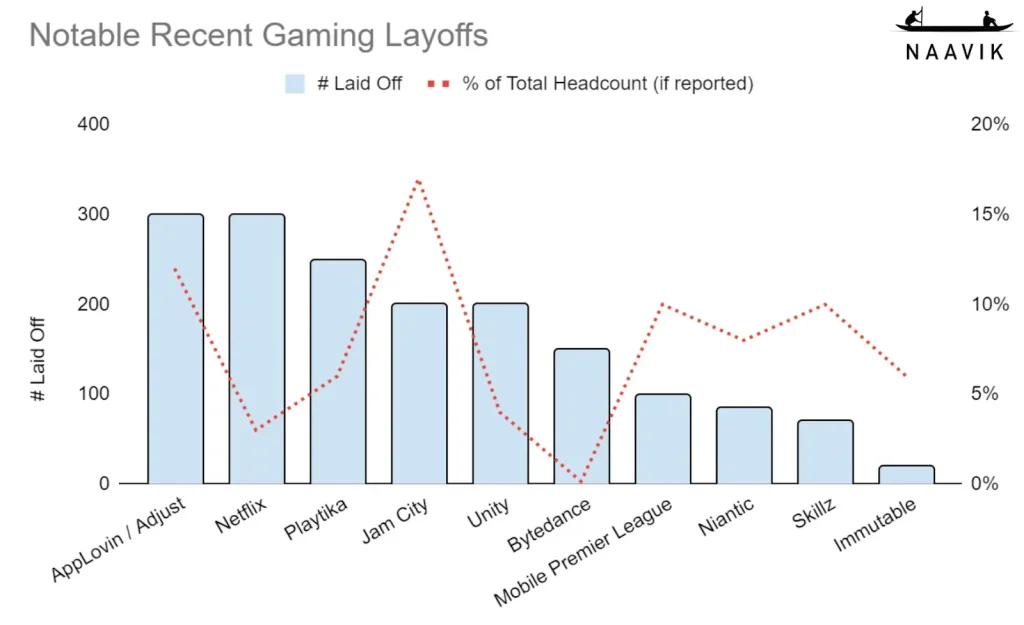

Analyzing Gaming Industry Layoffs: What the Numbers Tell Us

Layoffs have been a defining feature of recent years in the gaming sector, reflecting the pressure of elevated project risk, delayed titles, and strategic consolidation. The raw count of job cuts tells only part of the story; context matters, including the distribution of layoffs by studio size, genre focus, and geographic region. The broader message is that layoffs have not been uniform, and some sub-sectors or studios have adapted by pivoting to different production models or monetization strategies.

Employment trends in gaming are often shaped by survey participation biases—people who experienced disruption may be more likely to respond to employment surveys, which can skew the data. Nevertheless, year-on-year comparisons can still reveal meaningful shifts in the job market, helping job seekers and employers anticipate pressure points and opportunities within the video game industry.

The Role of Employment Surveys in Gaming: Insights and Caveats

Employment surveys in gaming provide a useful, if imperfect, snapshot of how workers perceive the job market. They help identify confidence levels, hiring intentions, and the relative balance between layoffs and openings. When interpreted carefully, these surveys can illuminate broader trends in video game industry hiring trends and serve as a counterpoint to more fragmented newsroom reports.

Caveats always apply—surveys are samples, and voluntary participation may bias results toward more disrupted experiences. Still, employing a consistent methodology over time allows analysts to track patterns, validate the momentum behind a recovery, and understand how factors like project lifecycles, wage dynamics, and skill shortages intersect with the employment survey gaming data.

Video Game Studio Staffing: From Layoffs to Hiring Spikes

Studio staffing strategies shift in response to the life cycle of projects. After waves of layoffs, studios may reconstitute core teams, fill critical skill gaps, and implement hiring freezes or targeted rehiring as budgets permit. The focus often moves from scale to strategic fit, prioritizing core competencies in programming, art, design, and QA to support high-potential projects.

As growth returns, studios pursue aggressive staffing in areas aligned with their pipelines, while also exploring outsourcing, contractors, and remote collaboration to balance speed and cost. The ongoing challenge for video game studios is to align staffing with the unpredictable timing of develop-to-launch cycles and to manage talent pipelines so that the next wave of projects can scale quickly without repeating past overextensions.

Hiring Trends in the Video Game Industry: A Closer Look at Year-on-Year Changes

Year-on-year changes in hiring reveal how quickly the industry absorbs talent after a downturn and how aggressively it expands as new projects come online. The trendlines often reflect broader economic conditions, investor sentiment, and the health of key franchises. For job seekers, tracking these changes helps identify windows of opportunity and the most robust domains within the video game industry hiring trends.

Beyond individual studios, aggregate data on hires by role, platform, or region helps map the game development jobs market. Analysts watch for shifts toward certain disciplines—such as gameplay programming, AI, or visual effects—and for movement between PC, console, and mobile segments. Understanding these patterns supports strategic career planning and smarter networking within the gaming ecosystem.

The Impact of Studio Closures on Talent Pools and Recruitment

Studio closures can dramatically shrink local talent pools, create spillover effects as employees seek roles elsewhere, and catalyze retraining efforts for displaced workers. When a studio shutters its doors, neighboring studios often absorb some of the experienced staff, and others pivot to freelancing, indie development, or new startup ventures. This churn reshapes the recruitment landscape for video game industry hiring trends.

For recruiters, closures underscore the value of maintaining robust talent pipelines, cross-project transfer opportunities, and partnerships with training programs. Workers, meanwhile, benefit from upskilling and portfolio diversification that make them attractive across the broader game development jobs market, including roles outside traditional studios such as middleware providers or educational outreach programs.

Regional Variations in the Gaming Workforce and Hiring Trends

Geography matters. Different regions exhibit distinct patterns in job openings, salary ranges, and demand for specialized skills. Some markets see rapid expansion in mobile and live-service titles, while others focus on AAA development or VR experiences. Understanding these regional shifts is essential for interpreting video game industry hiring trends at a granular level.

Remote work and distributed teams add another layer of complexity, allowing studios to tap talent beyond regional boundaries while also intensifying competition for specialized roles. For job seekers, this means exploring opportunities across multiple regions and considering how time zones, language, and collaboration tools impact team dynamics within the game development jobs market.

The Next Phase: What Employers Look for in Developers When Growth Returns

As growth returns, employers prioritize a blend of core discipline expertise and adaptable, collaborative skills. Technical proficiency remains critical, but studios increasingly value cross-disciplinary teams, rapid prototyping, and a demonstrated ability to work in agile environments. This shift shapes the hiring criteria that influence video game studio staffing decisions.

Investing in people who can metabolize feedback, iterate quickly, and contribute to both the design and production flow becomes a differentiator in a competitive market. For developers, this means aligning portfolios with current needs—such as gameplay programming, tools development, or user experience design—and highlighting experiences that translate across project lifecycles in the game development jobs market.

How Companies Communicate Hiring Plans: Signals from InGame Job and Similar Surveys

Communication from studios and publishers about hiring plans offers valuable signals to job seekers. When companies disclose timelines, headcount targets, or strategic priorities—often through job postings, press releases, or industry surveys—the market can respond with renewed interest and applicant flow. These signals contribute to the broader picture of video game industry hiring trends.

Interpreting these communications alongside the broader data from employment survey gaming and related sources helps workers time applications, tailor skill development, and approach interviews with a clear understanding of employer needs. While individual announcements may not guarantee openings, a pattern of proactive hiring messages generally points to a favorable phase in the game development jobs market.

Skills Shifts in the Game Development Jobs Market: Which Roles Are in Demand?

The demand for certain skills tends to rise in the wake of new platforms, engines, and monetization strategies. Core roles in programming, art, design, and QA remain foundational, but studios increasingly seek specialists in gameplay systems, UE/Unity pipeline optimization, AI behaviors, and live-service support. Keeping an eye on these shifts helps candidates align their training with video game studio staffing needs.

Equally important are transferable skills—prototyping, collaboration across disciplines, and experience with agile workflows. The game development jobs market rewards ability to contribute across a project’s lifecycle, from pre-production planning to post-launch updates. Job seekers who diversify their portfolios with multidisciplinary examples are well positioned to capitalize on evolving hiring trends.

Long-Term Outlook: Balancing Temporary Disruptions with Sustainable Growth

The broader outlook for the gaming industry remains cautiously optimistic. While short-term cycles can deliver volatility, careful talent planning, investment in training, and a focus on durable pipelines can smooth the path toward sustainable growth. From the perspective of video game industry employment trends, the goal is to build resilient teams that can scale with demand while navigating inevitable downturns.

For workers and studios, the key is ongoing talent cultivation and flexible staffing strategies that weather fluctuations in the gaming market. By staying informed about employment survey gaming results, monitoring video game industry hiring trends, and investing in video game studio staffing pipelines, the industry can better anticipate opportunities and minimize the impact of future cycles on people and projects.

Frequently Asked Questions

What are the current video game industry hiring trends?

The video game industry hiring trends reflect cyclical growth: after tough years, some expansion occurs, but overall hiring remains cautious. Data from industry surveys show selective hiring and gradual improvement rather than a broad boom, with studios staffing up where projects are active while others consolidate.

How have gaming industry layoffs affected job seekers?

Gaming industry layoffs have shrunk headcount in several waves, underscoring the importance of transferable skills and flexibility. Job seekers should focus on strong portfolios, diversify opportunities across studios still hiring, and monitor the game development jobs market for openings in resilient segments.

What does the employment survey gaming data say about the market?

Recent employment survey gaming data indicate modest year-on-year signals rather than rapid growth. While green shoots exist, they’re limited, and responses can be biased by who chooses to participate. Still, these surveys help track trends in video game industry hiring trends and overall stability.

How is video game studio staffing evolving in the current cycle?

Video game studio staffing shows a mix of selective expansion and consolidation. Some studios continue to grow teams on active projects, while others tighten roles or rely on flexible staffing. This shift affects opportunities across the video game studio staffing landscape.

What is the game development jobs market like for newcomers?

For newcomers, competition remains strong, but internships and junior roles persist at studios pursuing new projects. Building a solid portfolio, learning in-demand tools, and networking are key to breaking into the game development jobs market.

Are there regional differences in video game industry hiring trends?

Yes. Regional differences exist: some areas experience hiring activity and studio growth, while others face consolidation or layoffs. Local employment survey gaming data often highlights these contrasts within the broader video game industry hiring trends.

How should job seekers adapt to cycles of growth and consolidation in gaming?

Adaptability is crucial: broaden skills, stay current with industry tools, network with studios, and target organizations that continue to hire. Regularly review the video game industry hiring trends and employment survey gaming to time applications effectively.

What skills are most in demand in the game development jobs market?

In-demand skills typically include programming and engine proficiency (e.g., Unity, Unreal), gameplay design, art assets, and live ops. Aligning these with current video game studio staffing needs strengthens prospects in the game development jobs market.

How reliable are employment surveys in gaming for tracking trends?

Employment surveys in gaming provide useful trend signals but can be affected by response bias. Cross-checking multiple sources and focusing on year-over-year comparisons helps interpret the data reliably within the broader video game industry hiring trends.

What impact do studio closures have on the job market?

Studio closures often trigger layoffs and headcount reductions, yet they can be followed by new openings as other studios grow or pivot. Staying informed through employment survey gaming data and the video game industry hiring trends can help job seekers spot recovery signals in the market.

| Aspect | Key Points | Notes / Evidence |

|---|---|---|

| Industry cycles | Moves in cycles: tough years followed by boom; growth leads to consolidation and reinvestment. | Conventional wisdom; cyclical pattern seen in hiring and activity. |

| Hiring & layoffs | Many thousands of jobs lost; some companies grew but not enough to absorb laid-off staff; overall headcount shrank. | Reflects instability during downturns; uneven absorption during recoveries. |

| Early signs of growth | Turn of cycle could bring expansion; however growth signals are scarce. | InGame Job survey shows green shoots few and far between. |

| Survey interpretation | Voluntary responses can bias representativeness; year-on-year comparisons are more robust. | Potential biases acknowledged; data still instructive. |

| Leadership moves | Notable leadership changes noted (Double Eleven co-CEOs; former CEO steps down). | Leadership changes can influence strategic direction and hiring decisions. |

Summary

Video game industry employment trends show a sector that moves in cycles, with downturns followed by periods of growth and consolidation. The recent hiring environment has seen significant layoffs and studio closures, and headcounts overall contracted even where some studios grew. Signals of renewed expansion are sparse, and survey data—even with biases inherent to voluntary responses—still highlight that year-to-year comparisons can be informative. Looking forward, recovery may begin as the cycle turns, but momentum will likely vary by studio size, region, and business model.